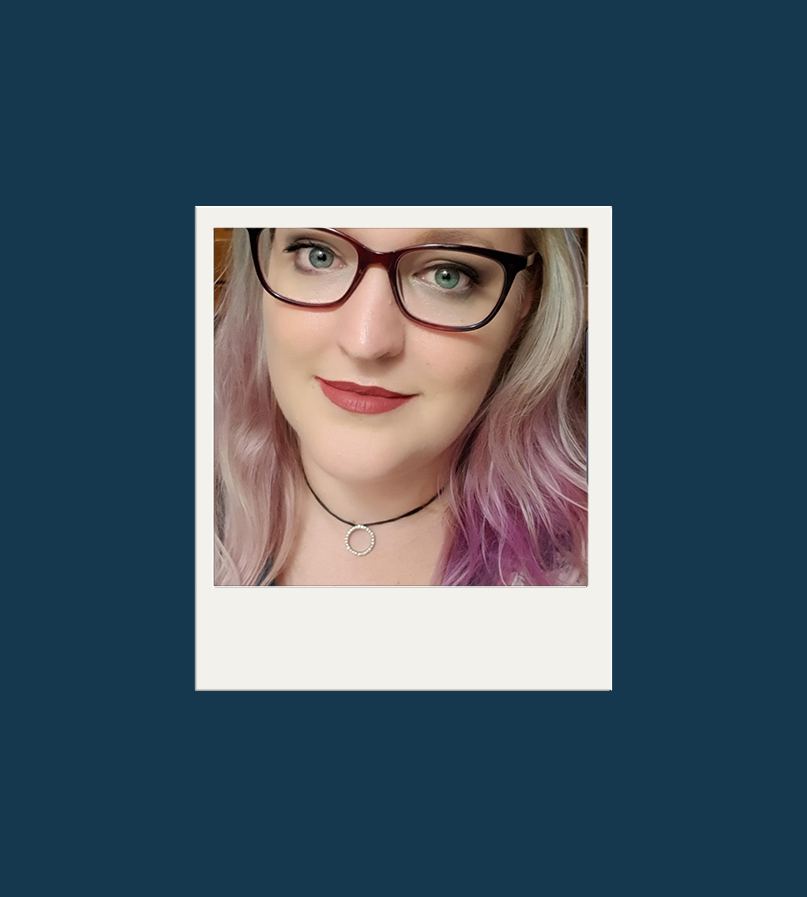

Like millions of Australians, Rebecca was struggling with her credit card debt. Because she was only making the minimum payments, her debt was building and she was overwhelmed. Having seen a post on social media, she decided to give Wisr a go.

It was hard for my partner and I to keep on top of our credit card debt. We tried to pay the bare minimum on our credit card, but unexpected expenses popped up and the interest climbed.

"I’ve gone from being overwhelmed and stressed to feeling in control and knowing that we’re making positive steps forward."

Bec

Disclaimer: This article contains general information only, and is not general advice or personal advice. Wisr Services does not recommend any product or service discussed in this article. You must get your own financial, taxation, or legal advice, and understand any risks before considering whether a product or service discussed in this article may be appropriate for you. We have taken reasonable efforts to ensure that the information is accurate at the time of publishing, but the information is subject to change. We may not update the article to reflect any change.