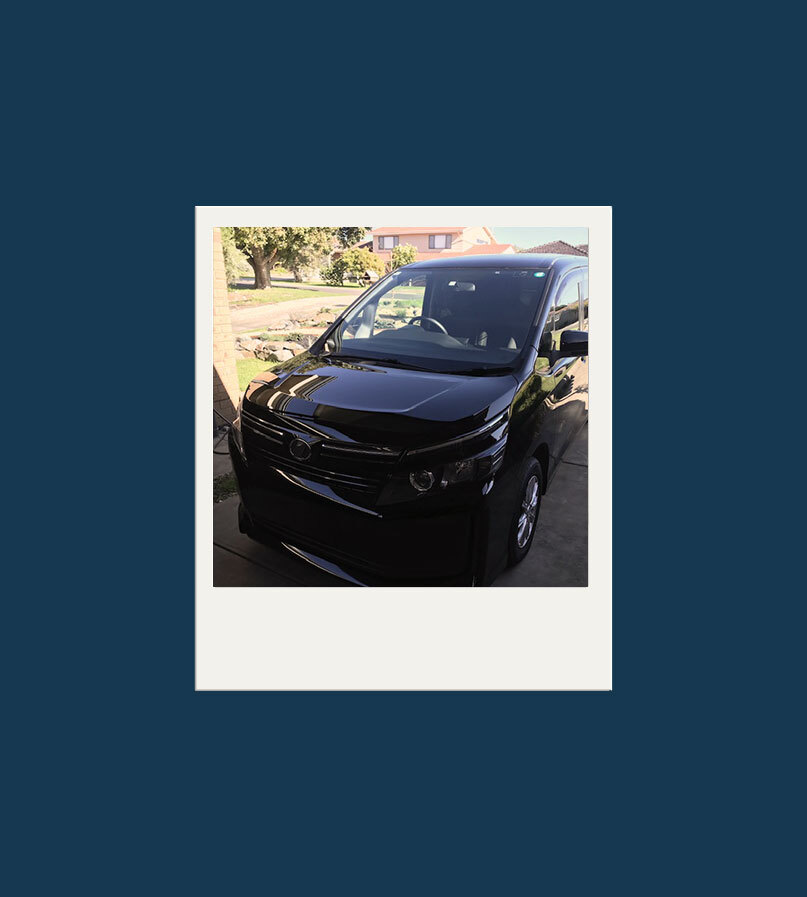

Julia came to Wisr needing help to buy a vehicle that would fit her husband’s 150kg wheelchair and massively improve their quality of life. This is her story.

“The borrowing process was far more open and friendly. It wasn't dominating, making me feel bad about myself at all. Borrowing from Wisr was like a partnership. It was like they were saying, ‘we have faith in you’. It was a really amazing process. They did it willingly and with faith.”

Julia, Wisr Loan Customer

Disclaimer: This article contains general information only, and is not general advice or personal advice. Wisr Services does not recommend any product or service discussed in this article. You must get your own financial, taxation, or legal advice, and understand any risks before considering whether a product or service discussed in this article may be appropriate for you. We have taken reasonable efforts to ensure that the information is accurate at the time of publishing, but the information is subject to change. We may not update the article to reflect any change.

Keep reading, we've got more

Check your loan options with Wisr

Think you could benefit from a personal loan? Get a quick rate estimate now without affecting your credit scores.